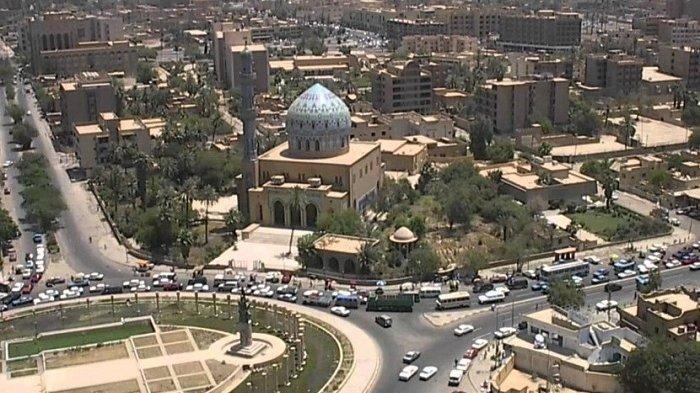

Kota Baghdad, ibukota Irak, memiliki sejarah yang kaya dan beragam, yang meliputi peradaban kuno, pengaruh Islam, dan dinamika kehidupan urban modern. Terletak di tepi Sungai Tigris, Baghdad telah menjadi pusat peradaban, perdagangan, dan ilmu pengetahuan selama berabad-abad. Artikel ini akan mengupas arsitektur, sejarah, dan kehidupan urban yang unik di Kota Baghdad.

Sejarah Panjang dan Ciri Budaya

Sejarah panjang dan ciri budaya merupakan dua aspek penting dalam memahami perkembangan suatu tempat atau masyarakat dari waktu ke waktu. Dalam konteks artikel tentang Baghdad, Irak, sejarah panjang dan ciri budaya merujuk pada perjalanan kota ini sepanjang berabad-abad dan identitas budaya yang menjadi ciri khasnya.

Sejarah Panjang

Sejarah panjang Baghdad dimulai pada abad ke-8 Masehi, saat Khalifah Al-Mansur mendirikan kota ini sebagai ibu kota baru Kekhalifahan Abbasiyah. Penetapan ini merupakan bagian dari upaya untuk menciptakan kota yang megah dan lebih cocok sebagai pusat pemerintahan dan perdagangan. Zaman Keemasan Islam pada abad ke-9 hingga ke-13 melihat Baghdad menjadi pusat ilmu pengetahuan, seni, dan budaya. “Rumah Kebijakan” didirikan di sini, menjadi tempat penelitian dan terjemahan karya-karya klasik dari berbagai budaya.

Kemudian, Baghdad mengalami berbagai pergantian kekuasaan, invasi, dan konflik, termasuk invasi Mongol pada abad ke-13 yang mengakibatkan kerusakan besar. Kota ini juga menjadi bagian dari Kekaisaran Ottoman dan pengaruh kolonialisme. Pada abad ke-20, Baghdad menjadi ibu kota Kerajaan Irak dan, kemudian, Republik Irak.

Ciri Budaya

Ciri budaya Baghdad tercermin dalam keragaman etnis, agama, dan warisan budaya yang ada di kota ini. Sebagai pusat Islam pada Zaman Keemasan, banyak ilmuwan, filsuf, dan seniman datang ke Baghdad, menciptakan lingkungan intelektual yang makmur. Penemuan dalam ilmu pengetahuan, matematika, kedokteran, dan seni melekat dalam identitas budaya Baghdad.

Kota ini juga memiliki ciri-ciri arsitektur Islam yang mencolok, seperti masjid-masjid yang megah dan ziggurat. Namun, seiring modernisasi, arsitektur modern dan fasilitas perkotaan juga menjadi bagian dari citra kota. Kehidupan urban di Baghdad mencerminkan perpaduan antara tradisi dan modernitas.

Kesimpulan

Sejarah panjang dan ciri budaya Baghdad memiliki pengaruh yang kuat dalam membentuk identitas kota ini. Dari masa Zaman Keemasan hingga tantangan kontemporer, Baghdad tetap menjadi pusat budaya, sejarah, dan kehidupan di Irak. Warisan intelektual, arsitektur megah, dan kehidupan urban yang beragam adalah ciri-ciri yang menggambarkan kekayaan budaya dan sejarah panjang kota ini.

Arsitektur Megah dan Warisan Budaya

Arsitektur megah dan warisan budaya adalah dua aspek penting yang menggambarkan karakteristik unik suatu tempat dan masyarakat dalam konteks sejarah dan perkembangannya. Dalam hal Baghdad, Irak, arsitektur megah dan warisan budaya berkontribusi pada kekayaan budaya dan identitas kota tersebut.

Arsitektur Megah

Arsitektur megah merujuk pada bangunan-bangunan yang mencolok, megah, dan sering kali memiliki nilai artistik dan sejarah yang tinggi. Dalam konteks Baghdad, terdapat beberapa bangunan dan struktur arsitektur megah yang menjadi ciri khas kota ini:

Gerbang Semua Bangsa (Baghdad Gate)

Juga dikenal sebagai Menara Tilted, ini adalah sisa-sisa gerbang kuno yang pernah menjadi bagian dari tembok pertahanan kota Baghdad. Meskipun saat ini hanya beberapa bagian yang tersisa, gerbang ini mencerminkan arsitektur kuno dan kejayaan masa lalu.

Masjid Al-Kadhimiyya

Masjid ini merupakan tempat bersemayamnya Imam Musa al-Kadhim, seorang figur penting dalam Islam Syiah. Arsitekturnya yang megah dengan kubah dan karya seni hiasan menggambarkan keagungan agama dan budaya.

Warisan Budaya

Warisan budaya mengacu pada nilai-nilai, tradisi, seni, dan pengetahuan yang diwariskan dari generasi ke generasi. Dalam hal Baghdad, warisan budaya sangat beragam dan tercermin dalam kehidupan sehari-hari masyarakat serta peninggalan sejarah:

Penelitian dan Karya Sastra

Zaman Keemasan Islam di Baghdad menyaksikan banyak ilmuwan, filsuf, dan penulis menghasilkan karya-karya monumental dalam berbagai bidang, dari matematika hingga sastra. Peninggalan ini menjadi bagian penting dari warisan budaya, dan banyak karya tersebut memengaruhi perkembangan ilmu pengetahuan dan pemikiran di seluruh dunia.

Seni Kaligrafi dan Hiasan

Seni kaligrafi dan hiasan Islam memiliki tempat khusus dalam budaya Baghdad. Tulisan Arab yang indah digunakan untuk menghiasi masjid, monumen, dan benda-benda seni, menciptakan keindahan visual yang unik.

Perlindungan dan Pemeliharaan Warisan

Perlindungan dan pemeliharaan warisan budaya dan arsitektur megah sangat penting untuk menjaga identitas budaya dan sejarah suatu tempat. Di Baghdad, konflik dan kerusakan telah mengancam beberapa situs bersejarah. Upaya perlindungan, restorasi, dan pendidikan budaya menjadi sangat penting untuk memastikan bahwa warisan ini tetap hidup dan dapat dinikmati oleh generasi mendatang.

Kesimpulan

Arsitektur megah dan warisan budaya berkontribusi pada karakteristik unik Baghdad sebagai kota dengan sejarah yang kaya dan budaya yang beragam. Dari monumen megah hingga peninggalan sejarah, keduanya membentuk gambaran yang indah tentang kekayaan budaya dan sejarah kota ini. Melalui upaya perlindungan dan pemeliharaan, warisan ini dapat terus dihargai dan dinikmati oleh generasi yang akan datang.

Perlindungan Warisan dan Masa Depan

Perlindungan warisan dan masa depan merujuk pada usaha untuk melestarikan warisan budaya, sejarah, dan lingkungan alam untuk generasi mendatang. Ini melibatkan tindakan untuk menjaga situs bersejarah, bangunan bersejarah, budaya tradisional, dan lingkungan alam agar tetap utuh dan dapat dinikmati oleh generasi yang akan datang.

Perlindungan Warisan

Perlindungan warisan melibatkan serangkaian langkah untuk mencegah kerusakan, penghancuran, atau hilangnya situs bersejarah, artefak, dan peninggalan budaya. Ini termasuk:

Konservasi dan Restorasi

Melakukan perawatan dan pemulihan fisik pada bangunan bersejarah dan artefak untuk menjaga integritas dan keaslian mereka.

Pengawasan dan Keamanan

Mengawasi situs bersejarah dan artefak dengan sistem keamanan, personel pengawasan, dan teknologi untuk mencegah perusakan atau pencurian.

Pendidikan dan Kesadaran Masyarakat

Meningkatkan kesadaran masyarakat tentang pentingnya melestarikan warisan budaya dan sejarah, serta mengedukasi tentang nilai-nilai budaya mereka.

Masa Depan

Masa depan warisan melibatkan perencanaan jangka panjang untuk menjaga dan mengembangkan warisan agar tetap relevan dan bermanfaat di masa yang akan datang:

Pengembangan Berkelanjutan

Mengembangkan solusi berkelanjutan untuk mengelola dan memanfaatkan warisan budaya dan lingkungan alam tanpa merusaknya.

Teknologi dan Inovasi

Menggunakan teknologi canggih seperti pemetaan digital dan simulasi 3D untuk dokumentasi, pemeliharaan, dan pemulihan.

Pendidikan dan Pelatihan

Melatih generasi baru dalam bidang konservasi, arkeologi, dan manajemen warisan untuk melanjutkan upaya perlindungan.

Tantangan dan Harapan

Perlindungan warisan dan masa depan menghadapi berbagai tantangan, termasuk konflik, perubahan iklim, dan urbanisasi. Namun, upaya yang konsisten dan kolaboratif dari pemerintah, lembaga internasional, organisasi masyarakat sipil, dan masyarakat umum dapat mengatasi tantangan ini.

Masa depan warisan adalah tentang memastikan bahwa warisan budaya dan alam tetap menjadi sumber inspirasi, pengetahuan, dan identitas bagi generasi mendatang. Dengan tindakan yang tepat, kita dapat mewariskan dunia yang kaya akan cerita, nilai, dan keindahan kepada anak cucu kita.

Modernisasi dan Tantangan Kontemporer

Modernisasi dan tantangan kontemporer merujuk pada perubahan sosial, ekonomi, dan politik yang terjadi sebagai hasil dari perkembangan teknologi dan perubahan dalam masyarakat. Namun, modernisasi juga dapat membawa tantangan yang kompleks yang mempengaruhi berbagai aspek kehidupan.

Modernisasi

Modernisasi adalah proses di mana masyarakat mengadopsi teknologi, ide, dan praktik baru yang mengubah cara hidup mereka. Ini melibatkan perkembangan infrastruktur, pendidikan, teknologi, dan ekonomi. Modernisasi dapat membawa manfaat besar, seperti peningkatan kualitas hidup, akses informasi, dan peluang ekonomi. Dalam konteks Baghdad atau kota-kota lain di seluruh dunia, modernisasi dapat dilihat dalam bentuk-bentuk berikut:

Infrastruktur

Pembangunan gedung pencakar langit, jalan raya, jembatan, dan fasilitas umum modern yang mempermudah mobilitas dan aksesibilitas.

Teknologi

Penyebaran teknologi informasi dan komunikasi, termasuk akses ke internet dan layanan digital, yang merubah cara berkomunikasi dan berinteraksi.

Pendidikan dan Inovasi

Pengembangan pendidikan yang lebih baik, peningkatan akses ke informasi, dan dukungan untuk inovasi dan kreativitas.

Tantangan Kontemporer

Meskipun modernisasi membawa banyak manfaat, juga ada tantangan yang muncul sebagai akibat dari perubahan ini:

Kesenjangan Sosial

Peningkatan ekonomi dan teknologi tidak selalu merata, mengakibatkan kesenjangan ekonomi dan sosial yang dapat menciptakan ketidaksetaraan.

Pengabaian Tradisi

Dalam beberapa kasus, modernisasi dapat mengakibatkan penurunan nilai-nilai budaya dan tradisi yang dianggap tidak relevan atau ketinggalan zaman.

Perubahan Lingkungan

Perkembangan ekonomi dan perkotaan dapat berdampak pada lingkungan alam, termasuk polusi, kerusakan ekosistem, dan perubahan iklim.

Ketidakstabilan Sosial dan Politik

Modernisasi dapat memicu ketidakstabilan politik dan sosial jika tidak dielola dengan baik, terutama jika perubahan ekonomi dan sosial terjadi terlalu cepat.

Pemeliharaan Keseimbangan

Penting untuk mencapai keseimbangan yang tepat antara modernisasi dan pemeliharaan nilai-nilai budaya, lingkungan, dan stabilitas sosial. Modernisasi yang berkelanjutan dan inklusif harus mempertimbangkan dampaknya terhadap masyarakat dan lingkungan, serta berusaha untuk meminimalkan dampak negatif yang mungkin timbul.

Dalam kasus Baghdad atau kota-kota lain, pemeliharaan budaya dan identitas lokal seiring dengan modernisasi adalah kunci untuk membangun masa depan yang berkelanjutan dan harmonis. Dengan menghormati warisan sejarah dan nilai-nilai budaya, sambil mengadopsi inovasi dan teknologi modern, masyarakat dapat menghadapi tantangan kontemporer dengan lebih baik.

Baca Juga Artikel : Warisan Kuno Irak: Membongkar Kejayaan Peradaban Sumeria dan Babilonia

Kesimpulan

Kota Baghdad mewakili jembatan antara masa lalu dan masa depan Irak. Dengan sejarah panjang yang mencakup berbagai peradaban, nilai-nilai Islam, dan semangat masyarakat yang tangguh, Baghdad adalah cerminan kekayaan budaya dan dinamika kehidupan urban. Meskipun menghadapi tantangan, kota ini terus bertumbuh dan beradaptasi, sambil menjaga warisan yang berharga untuk generasi mendatang.

SITUS GACOR DAN MUDAH MAXWIN HANYA ADA DI

Pentingnya Menghitung Odds Gacor69. Bermain judi online di situs Gacor69, bisa menghibur dan menguntungkan jika dilakukan dengan bijak. Aspek penting yang perlu dipahami oleh pemain adalah menghitung odds atau peluang dalam permainan. Odds adalah ukuran yang menggambarkan kemungkinan hasil tertentu dalam sebuah permainan. Mengerti cara menghitung dan menganalisis odds dapat membantu pemain meningkatkan peluang dan memaksimalkan pengalaman di Gacor69 ini.

Pentingnya Menghitung Odds Gacor69. Bermain judi online di situs Gacor69, bisa menghibur dan menguntungkan jika dilakukan dengan bijak. Aspek penting yang perlu dipahami oleh pemain adalah menghitung odds atau peluang dalam permainan. Odds adalah ukuran yang menggambarkan kemungkinan hasil tertentu dalam sebuah permainan. Mengerti cara menghitung dan menganalisis odds dapat membantu pemain meningkatkan peluang dan memaksimalkan pengalaman di Gacor69 ini.